Looking for a more reliable alternative to payday loans? Fast Money’s Monthly Loan gives you fixed monthly payments over 3–72 months, allowing you to borrow more responsibly. You can borrow up to 6× your monthly income, with transparent costs and no surprise rollover fees. It’s ideal for covering larger expenses with less financial stress.

Key Benefits:

- Fixed Monthly Repayments

You pay a consistent amount each month, making budgeting easier.

- Fast Approval and Disbursement

Loans are often approved and disbursed within 24 hours.

- Transparent Fees and Rates

Interest is capped at 4% monthly, with no hidden charges.

- Legally Regulated

All licensed moneylenders follow Ministry of Law guidelines.

- No Collateral Needed

You don’t need to pledge any assets to get approved.

- Open to Foreigners and PRs

Non-citizens with valid work passes can apply.

- Credit-Friendly

Even borrowers with lower credit scores may be eligible.

Who Can Apply?

- Singapore Citizens, PRs, and Foreigners with valid work passes

- Aged 21 to 65.

- Earning at least S$1,800–S$2,000/month

- Documents needed:

o NRIC/FIN.

o Payslips or income proof.

o CPF or bank statements.

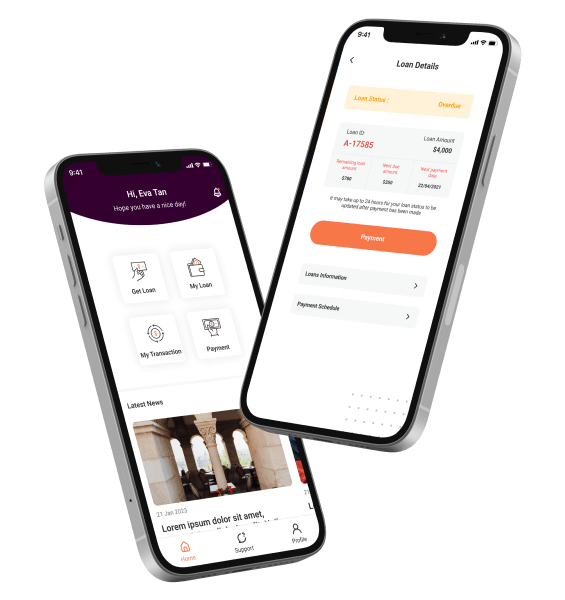

How It Works:

- Apply online or at Fast Money’s branch.

- Upload documents like ID and income proof.

- Get reviewed and receive approval.

- Sign agreement digitally or in person.

- Receive funds.

Loan Terms & Costs

- Interest: Up to 4% per month.

- Admin Fee: Up to 10% of loan amount.

- Tenure: From 3 to 72 months.

With clear terms, flexible options, and fast processing, Fast Money’s Monthly Loans are designed to support your financial needs, without the pitfalls of short-term borrowing. Check your eligibility and estimate repayments using our calculator now.