Renovation Loans:

A renovation loan is a financing solution designed to help homeowners or tenants revamp their space, whether it’s upgrading the kitchen or redoing the flooring. In Singapore, you can typically borrow up to six times your monthly income, or a maximum of S$30,000 for a renovation loan, whichever is lower. However, the final amount depends on factors like your credit profile, earnings, and age, and is subject to approval.

Who All Can Avail?

Renovation loans are open to Singaporeans, PRs, and foreigners with valid tenancy, aged 21 to 65, earning at least S$1,800 – S$2,000 per month.

Documents Checklist:

Homeowners must provide proof of ownership; tenants need landlord consent. Key documents include your NRIC, income slips or CPF contribution, renovation plans, and contractor’s quote.

Renovation Loan vs. Other Loans

Compared to personal or credit card loans, renovation loans often come with lower monthly interest rates (1%–4%) and are collateral-free. While personal loans may be used for any purpose, renovation loans are strictly tied to home improvements, with approval often based on submitted renovation plans.

| Loan Type | Interest Rate (per month) | Tenure | Purpose / Features |

| Renovation Loan | 1% – 4% | 12–60 months (1–5 years) | Home upgrades |

| Personal Loan | 1% – 4% | 6–60 months | General use |

| Credit Card Loan (Cash Advance) | ~3%–5% fee + ~1.5%–3% interest (compounded daily) | Revolving; no fixed tenure | High interest debts |

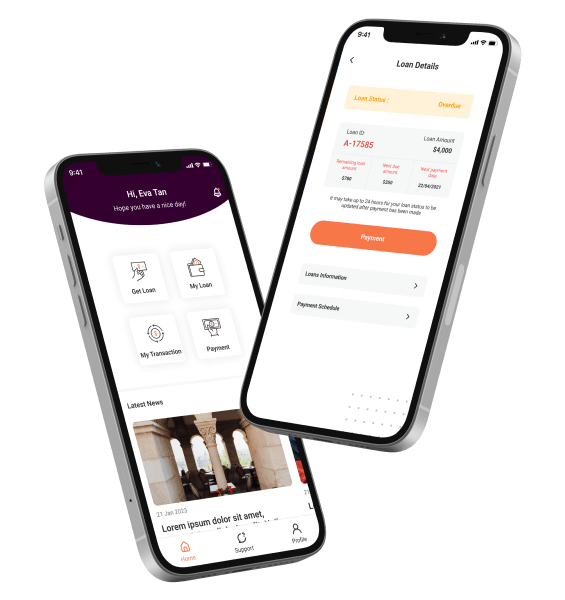

How It Works: 5-Step Journey

- Apply Online or In-Person, at Fast Money’s branch.

- Submit Renovation Plans & Quote.

- Loan Assessment & Approval.

- Funds Disbursed to Contractor/You.

- Monthly Repayment Begins.

Fast Money’s Renovation Loan in Singapore provides a quick, flexible, and straightforward solution for financing home upgrades with minimal hassle. Check your eligibility and estimate repayments using our calculator now.