Foreigner Loan Singapore – Fast, Simple, and Hassle-Free

Living and working in Singapore as a foreigner comes with its own set of challenges. From managing daily expenses to dealing with sudden emergencies, financial needs can arise anytime. However, securing a loan from traditional banks often feels impossible without a strong credit history or permanent residency. This is where foreigner loans in Singapore step in to bridge the gap.

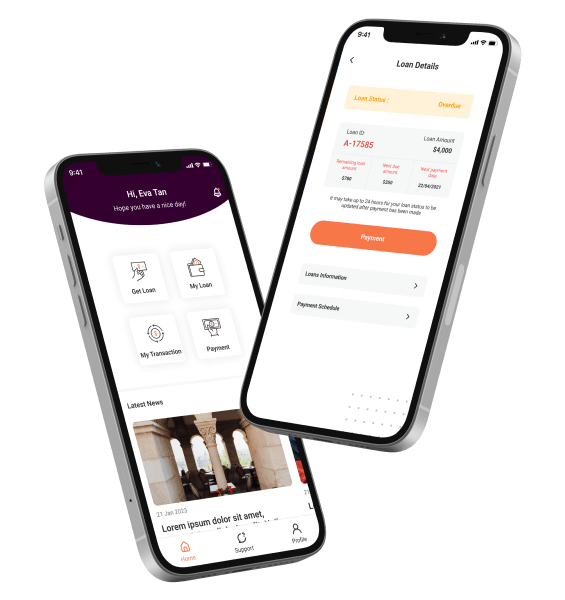

At Fast Money, we make it easy for foreigners and work permit holders to access cash loans with speed, simplicity, and dependable service. Our foreigner loan is designed to make financial access easier, offering fast approval, minimal paperwork, and same-day disbursement. That means you will have access to the cash you need right when you need it – completely hassle-free.

What is a Foreigner Loan?

A foreigner loan is a short-term personal loan designed specifically for non-residents, expatriates, and work permit holders living in Singapore. Unlike conventional bank loans, foreigner loans come with fewer requirements, so you don’t need years of credit history or collateral to qualify. The process is straightforward: a simple application, quick review, and fast approval. Whether it’s covering medical bills, rent, education, or urgent personal expenses, a foreigner loan gives you immediate financial breathing room.

Features & Benefits of Fast Money’s Foreigner Loan

- Quick and straightforward application process.

- Same-day cash disbursement for approved loans.

- No collateral required to qualify.

- Clear, transparent terms with no hidden fees.

- Multilingual support for easy communication.

- Flexible repayment plans suited to your income cycle.

How to Apply

The process of applying for a foreigner loan in Singapore with Fast Money is clear and easy:

- Fill out our online form or contact our team directly.

- Submit the required identification and employment documents.

- Receive confirmation of approval.

- Get your cash disbursed the very same day.

Accessing funds in Singapore doesn’t have to be a complicated or frustrating process, especially when you’re far from home and may not have an established credit history here. With Fast Money’s foreigner loan, you can secure the financial support you need. Whether you’re a work permit holder handling unexpected expenses, an expatriate settling into life in Singapore, or simply someone who needs a little extra support to manage daily costs, we’re here to help.

Apply Now with Fast Money!