A Line of Credit (LOC) Loan from Fast Money is a flexible, revolving credit facility that allows you to draw funds up to an approved limit. You only pay interest on what you use, making it ideal for fluctuating cash needs, unlike fixed personal loans where the full amount is disbursed at once.

Types of LOC:

- Unsecured LOC – No collateral required; interest is charged on the drawn amount.

- Secured LOC – Backed by collateral; may offer lower interest rates.

Key Benefits & Ideal Use Cases

- Only pay interest on used funds.

- Access cash anytime within your limit.

- Great for managing irregular expenses like home repairs or tuition.

- Can be used repeatedly after repayment.

To be eligible, borrowers should be:

- Aged 21–65.

- Singapore citizen, PR, or foreigner with a valid work pass.

- Earning at least S$1,800-S$2,000/month.

- Having documents like NRIC/FIN, payslips, CPF or bank statements, and proof of collateral if needed.

Costs & Fees

- Interest Rate: Variable, up to 4% per month, paid only on withdrawn amounts.

- Admin Fee: Typically up to 10% of credit limit, charged upfront.

- Renewal / Draw Fees: May apply, depending on usage.

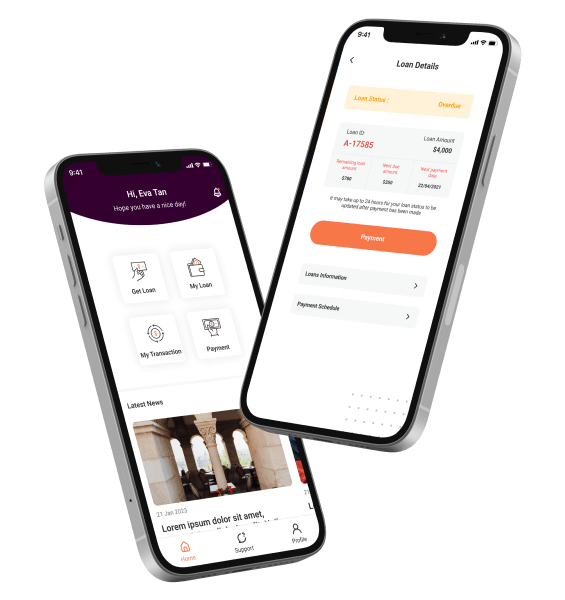

Application & Process

- Apply online or in branch.

- Submit ID and income documents.

- Approval and disbursement in 24 hours.

- Sign the LOC agreement.

- Access funds.

LOC vs Personal Loan:

| Feature | Line of Credit | Personal Loan |

| Disbursement | Revolving as needed | Lump sum at drawdown |

| Repayment | Interest on used funds | Interest on full amount |

| Flexibility | High – reuse available | Fixed terms and limits |

| Interest Structure | Variable | Fixed or variable |

| Ideal For | Ongoing or sporadic expenses | One-time purchases or consolidation |

Fast Money’s Line of credit loan in Singapore gives you flexible access to funds, without the stress of fixed loan disbursements. Check your eligibility and estimate repayments using our calculator now.